Helpful Articles

From Our Team

SORT BY TOPIC

Behavioral Health

Social Work Month: The Steady Hands Behind Behavioral Health Care

READ MORE >

Public Health,

Healthcare Technology

How EHRs Support Effective STD and STI Treatment

READ MORE >

Behavioral Health,

Artificial Intelligence

AI in Behavioral Health: What Clinicians Should Watch For

READ MORE >

Medical Billing,

Practice Management

Fee-for-Service vs. Value-Based Care: What Organizations Need to Know

READ MORE >

Public Health,

Healthcare Technology

Top Public Health Trends for 2026

READ MORE >

Practice Management

How to Improve Mental Health in the Workplace for Healthcare

READ MORE >

Patagonia Health News

LHDs Leverage EHR to Strengthen SDOH Screening and Referrals

READ MORE >

Healthcare Technology

Choosing an EHR with Exceptional Support & Service for Health Care Teams

READ MORE >

Public Health,

Interoperability

The $50 Billion RHT Program: Why Local Health Departments Drive Rural Transformation

READ MORE >

Public Health

Public Health Emergency Preparedness Guide

READ MORE >

Public Health,

Patient Experience

Community Engagement and Health Improvement Strategies

READ MORE >

Public Health,

Financial Wellness

Turning Public Health Data into Action: A Leader's Guide

READ MORE >

Public Health,

Financial Wellness

How Rural Health Departments Can Thrive with EHRs

READ MORE >

Healthcare Technology

The Complete History of Electronic Health Records

READ MORE >

Medical Billing,

Healthcare Technology

Why Every School Needs an EHR System

READ MORE >

Patagonia Health News

Patagonia Health Named 2025 Triangle Fast 50 Winner

READ MORE >

Public Health,

Healthcare Technology

Enhancing Patient Care with EHRs for Public Health Nurses

READ MORE >

Behavioral Health,

Public Health

HIPAA-Compliant Notes: Protect Patient Data in Clinical Documentation

READ MORE >

Behavioral Health,

Practice Management

Psychology vs. Psychiatry

READ MORE >

Behavioral Health,

Interoperability

School Mental Health Assessments for Early Intervention

READ MORE >

Public Health

Community Health vs. Public Health

READ MORE >

Public Health,

Healthcare Technology

How EHRs Strengthen Public Health's Fight Against Opioid Addiction

READ MORE >

Patagonia Health News

Patagonia Health Named One of Triangle's Best Places to Work

READ MORE >

Patient Experience

Understanding the Social Determinants of Health

READ MORE >

Public Health,

Healthcare Technology

How EHRs Support Public Health Programs and Improve Outcomes

READ MORE >

Behavioral Health,

Healthcare Technology

7 Reasons to Get a Cloud-Based EHR for Mental Health

READ MORE >

Behavioral Health,

Public Health

9 Must-Have EHR Features for Small Practices

READ MORE >

Behavioral Health,

Healthcare Technology

How EHRs Revolutionize Mental Health Care for Anxiety and Depression

READ MORE >

Behavioral Health,

Healthcare Technology

Best EHR for Private Practice: A Comprehensive Guide for Therapists

READ MORE >

Patagonia Health News

Patagonia Health Celebrates the Success of User Group Events

READ MORE >

Practice Management,

Healthcare Technology

Best Features for a Practice Management Software

READ MORE >

Behavioral Health,

Healthcare Technology

What to Look for in Substance Abuse Software for Your Treatment Center

READ MORE >

Data Security,

Expert Interviews

Expert Interview: Aligning Healthcare System Updates with Regulations

READ MORE >

Behavioral Health,

Data Security

Choosing a HIPAA-Compliant Mental Health EHR

READ MORE >

Behavioral Health,

Healthcare Technology

How EHR Systems Streamline Mental Health Assessments

READ MORE >

Behavioral Health,

Medical Billing

Finding the Right Billing Software for Therapists

READ MORE >

Behavioral Health,

Healthcare Technology

How EHRs Empower Trauma-Informed Care

READ MORE >

Public Health,

Patient Experience

How an EHR Improves Patient Safety

READ MORE >

Behavioral Health,

Medical Billing

How Accounting and Billing Technology Empowers Therapists

READ MORE >

Behavioral Health,

Interoperability

How to improve Interoperability in Healthcare

READ MORE >

Behavioral Health

Mastering Clinical Documentation: A Practical Guide to Progress Notes

READ MORE >

Behavioral Health

The Best EHR for Psychiatrists

READ MORE >

Patagonia Health News

Patagonia Health Wins 2025 Stevie Award

READ MORE >

Behavioral Health,

Healthcare Technology

The Ultimate Guide to EHR Implementation for Mental Health Clinics

READ MORE >

Data Security,

Expert Interviews

Expert Interview: Harbi Dhanjal | Securing Your Health Organization

READ MORE >

Patagonia Health News

Patagonia Health Wins Triangle Business Fast 50 Award 2024

READ MORE >

Financial Wellness

Is the Sun Setting on Your Current EHR System?

READ MORE >

Patagonia Health News

Enhanced Custom Forms App by Patagonia Health

READ MORE >

Patagonia Health News

Introducing Patagonia Health Academy (eLearning Module)

READ MORE >

Behavioral Health

Breaking the Cycle: Deflection and Diversion Prevent Opioid Overdose

READ MORE >

Behavioral Health,

Practice Management

Weaving the Golden Thread for Clinical Documentation

READ MORE >

Healthcare Technology,

Expert Interviews

Expert Interview: Jolie Rollins & Monique Dever

READ MORE >

Industry News,

Interoperability

How the HTI Rules Are Reshaping Health Data

READ MORE >

Behavioral Health,

Industry News

ASAM 4th Edition Criteria for Behavioral Health Clinicians

READ MORE >

Behavioral Health

Tools for Mobile Integrated Health Services in Behavioral Health

READ MORE >

Behavioral Health

Benefits of Mobile Integrated Health for Behavioral Health

READ MORE >

Patagonia Health News

Patagonia Health Wins Gold Award for Sales and Customer Service

READ MORE >

Patagonia Health News

Patagonia Health Launches Ideas Portal for Feature Requests

READ MORE >

Medical Billing,

Public Health

They’re Going Around: Local Health Department Billing Headaches

READ MORE >

Medical Billing,

Financial Wellness

Improve Your Collections Process with 5 Easy Changes

READ MORE >

Patagonia Health News

Patagonia Health Promotes Prasad Naik as VP of Finance

READ MORE >

Patagonia Health News

Patagonia Health Celebrates 15 Years of Service

READ MORE >

Patagonia Health News

Patagonia Health Streamlines its Clinical Form Update Process

READ MORE >

Patagonia Health News

Patagonia Health Offers FPAR 2.0 Reporting

READ MORE >

Financial Wellness

Sustainable Healthcare: The Benefits of Going Paperless

READ MORE >

Interoperability,

Financial Wellness

Why Should I Choose a Cures Act Certified EHR?

READ MORE >

Patient Experience

6 Strategies to Boost Patient Engagement

READ MORE >

Interoperability,

Financial Wellness

School Health: Why Should My EHR Be FERPA Certified?

READ MORE >

Patient Experience,

Healthcare Technology

How Your EHR Can Improve Health Equity

READ MORE >

Financial Wellness

Managing Your EHR Implementation Timeline

READ MORE >

Public Health

The 5 A’s for Smoking Cessation Interventions

READ MORE >

Financial Wellness,

Healthcare Technology

EHRs Can Improve Efficiency of High Volume Immunizations

READ MORE >

Patagonia Health News

Introducing our New Appointment Adherence App

READ MORE >

Patagonia Health News

“Patagonia Health Pioneers” Recognized for 10+ Years of Service

READ MORE >

Patagonia Health News

Patagonia Health Certified as an NC Minority-Owned Business

READ MORE >

Patagonia Health News

Patagonia Health Wins 2023 Stevie Award

READ MORE >

Public Health,

Healthcare Technology

How EHRs Help Public Health Win the War Against TB

READ MORE >

Financial Wellness

10 Questions to Ask in Your EHR RFP and Vendor Demo

READ MORE >

Interoperability,

Expert Interviews

Expert Interview: Komal Sadani

READ MORE >

Industry News,

Financial Wellness

The Mental Health Matters Act– EHR Functionalities for School Health

READ MORE >

Patagonia Health News

Patagonia Health Joins Forces with Fairfax County Health Department

READ MORE >

Patagonia Health News

Patagonia Health Wins Triangle Business Fast 50 Award

READ MORE >

Financial Wellness

EHR Selection and Implementation Success: Common Q & As

READ MORE >

Patient Experience,

Patient Portal

How an EHR Improves Patient Care

READ MORE >

Healthcare Technology,

Expert Interviews

Expert Interview: Don Sargent

READ MORE >

Financial Wellness

Your Modern-day EHR Can't Be DIY

READ MORE >

Behavioral Health,

Public Health

Fentanyl Crisis - How an EHR Can Help

READ MORE >

Patient Experience,

Telehealth

Providing a Better Telehealth Experience

READ MORE >

Behavioral Health,

Public Health

Community Violence: How an EHR can Help

READ MORE >

Financial Wellness,

Healthcare Technology

How EHRs Reduce Medical Costs for Providers

READ MORE >

Public Health,

Healthcare Technology

How an EHR Can Support Men’s Health

READ MORE >

Behavioral Health,

Telehealth

Telehealth Group Therapy Functionality Now Expanded

READ MORE >

Patagonia Health News

Patagonia Health Connects to Multiple State-Run Immunization Registries

READ MORE >

Telehealth,

Financial Wellness

Inflation and the Need for Telehealth Access

READ MORE >

Financial Wellness

EHR Total Cost of Ownership: Pricing You can Trust

READ MORE >

Patagonia Health News

Patagonia Health Wins 2022 Stevie Award!

READ MORE >

Patagonia Health News

Patagonia Health Offers Free 2-Factor Authentication for EHR

READ MORE >

Healthcare Technology

Understanding the Differences: EMR vs EHR

READ MORE >

Interoperability,

Healthcare Technology

Public Health 3.0 Framework and EHRs to Support it

READ MORE >

Healthcare Technology

EHR Apps Study Spells the Future of Healthcare

READ MORE >

Public Health

Opioid Abuse Prevention in Chronic Pain Patients

READ MORE >

Behavioral Health

Behavioral Health Trends for 2026

READ MORE >

Behavioral Health,

Public Health

Adolescent Mental Health Support for Caregivers and Health IT Leaders

READ MORE >

Financial Wellness

Tips to Support Employee Mental Health

READ MORE >

Financial Wellness

Employee Retention Strategies in Healthcare

READ MORE >

Industry News

Major Healthcare Regulations for 2026

READ MORE >

Financial Wellness

Personalization, Configuration and Customization in EHR Design

READ MORE >

Financial Wellness

How to Migrate data to a new EHR Successfully

READ MORE >

Financial Wellness

How to Train New Employees in your EHR when you‘re Busy

READ MORE >

Public Health

How EHRs support Diabetes & Smoking Cessation Programs

READ MORE >

Practice Management,

Healthcare Technology

Everything Public Health Professionals Need to Know About FPAR 2.0 Reporting

READ MORE >

Financial Wellness

Implementation Best Practices for EHRs

READ MORE >

Financial Wellness

Cloud Based Complete EHR Systems: Solving the Build it or Buy it Debate

READ MORE >

Patagonia Health News

Jonathan Strange Hired as Patagonia Health's Clinical Director

READ MORE >

.jpeg?width=400&name=AdobeStock_1085889895%20(1).jpeg)

Financial Wellness

How to Know When to Transition to Another EHR

READ MORE >

Behavioral Health

Adolescent Behavioral Health: Solutions for a National Emergency

READ MORE >

Behavioral Health,

Public Health

Behavioral Health Integration: EHR Support for Co-Treatment

READ MORE >

Patient Experience

Social Determinants of Health: Two Perspectives

READ MORE >

Interoperability,

Practice Management

EHR Interoperability: Playing Well with Others

READ MORE >

Telehealth

Telehealth or Virtual Meetings? How to tell the difference

READ MORE >

Patient Experience,

Healthcare Technology

Whole Person Care and the Role of EHRs

READ MORE >

Patient Experience,

Practice Management

Texting is Now a Vital Part of Patient Communications

READ MORE >

Behavioral Health

IM+Cans: A Paradigm Shift in Behavioral Health Clinical Tools

READ MORE >

Interoperability,

Practice Management

The Cures Act: How EHRs Play a Part

READ MORE >

Industry News,

Interoperability

Trend of Health Information Exchanges Merging and Linking

READ MORE >

Patagonia Health News

Patagonia Health Launches Time and Effort Tracking App

READ MORE >

Data Security

How to Defend Against the Rise of Ransomware

READ MORE >

Financial Wellness

Finding a Trustworthy EHR Vendor

READ MORE >

Patagonia Health News

Patagonia Health Joins the Carequality Network

READ MORE >

Behavioral Health,

Telehealth

Guidelines for Using Telehealth for Group Therapy

READ MORE >

Financial Wellness,

Patient Portal

Alleviate Staffing Shortages with an EHR and Patient Self Services

READ MORE >

Patagonia Health News

Patagonia Health Hires Clark McKenna: Strategic Account Executive

READ MORE >

Financial Wellness

EHR Implementation Success: 7 Tips

READ MORE >

Data Security

Staff Moves: Increasing Security and Protecting Patient Data

READ MORE >

Patagonia Health News

Customer Service Success: Patagonia Health Wins 2021 Stevie Award

READ MORE >

Telehealth

Benefits of an Embedded EHR Telehealth Tool

READ MORE >

Patagonia Health News

Patagonia Health now supporting MS Edge Browser

READ MORE >

Financial Wellness,

Healthcare Technology

Use a Cloud-Based EHR to Reduce Costs

READ MORE >

Financial Wellness

How to Evaluate EHR Solutions

READ MORE >

Public Health

Modernize Public Health Infrastructure to Defend Against Emerging Viruses

READ MORE >

Patagonia Health News

Patagonia Health Piloting New Contactless Patient Experience App

READ MORE >

Healthcare Technology

Usability versus Learnability in EHR User Interface

READ MORE >

Financial Wellness

Shopping for an EHR - 8 things to find out First

READ MORE >

Industry News

Do Individuals have to Disclose Vaccination Status?

READ MORE >

Behavioral Health

EHR Implementation for Behavioral Health Challenges

READ MORE >

Data Security

Protect Patient Data from CyberAttack: 5 EHR Security Features

READ MORE >

Financial Wellness

Combat Digital Burnout with these 3 EHR Solutions

READ MORE >

Healthcare Technology

EHRs for E-Prescriptions and Drug Monitoring Programs

READ MORE >

Medical Billing,

Financial Wellness

Bill to Adopt the CCBHC Medicaid Demonstration Nationwide

READ MORE >

Financial Wellness

Optimize IT Spending: How EHR Support Affects your Bottom Line

READ MORE >

Financial Wellness

Traumatic Stress: Protecting Health Staff

READ MORE >

Industry News,

Data Security

Internet Explorer Security is going away: Is it taking yours with it?

READ MORE >

Public Health

Communication Tips for the Importance of Immunizations

READ MORE >

Patagonia Health News

Patagonia Health Offers Interface to PHIN Public Health Information Network

READ MORE >

Public Health,

Industry News

The Threat to Mental Health during COVID-19 & How Practitioners Can Help

READ MORE >

Patagonia Health News

Patagonia Health: Adapt & Innovate, At Speed

READ MORE >

Patagonia Health News

Patagonia Health Supports Mass Vaccination Campaigns

READ MORE >

Behavioral Health

The Golden Thread: Tell a Story of the Entire Treatment Journey

READ MORE >

Patagonia Health News

Patagonia Health EHR Wins Bronze Stevie Award for Customer Service

READ MORE >

Patagonia Health News

Patagonia Health Develops Integrated Telehealth Solution

READ MORE >

.jpeg?width=400&name=AdobeStock_532389552%20(1).jpeg)

Telehealth

Telehealth is Here to Stay

READ MORE >

Behavioral Health,

Public Health

Telehealth Best Practices: Enhancing Webside Manner

READ MORE >

Behavioral Health

Mental Health Awareness Month

READ MORE >

Public Health,

Practice Management

Contact Tracing and Next Steps

READ MORE >

Patagonia Health News

Patagonia Health Connected with Carequality Interoperability Framework

READ MORE >

Public Health,

Patagonia Health News

Patagonia Health Featured in KLAS COVID-19 Technology Guide

READ MORE >

Telehealth,

Industry News

New Rules for Telehealth Technology

READ MORE >

Patagonia Health News

Patagonia Health Launches COVID-19 Risk Assessment Tool

READ MORE >

Financial Wellness

Becoming a Certified Community Behavioral Health Clinic (CCBHC): Part 2

READ MORE >

Behavioral Health

Becoming a Certified Community Behavioral Health Clinic (CCBHC): Part 1

READ MORE >

Behavioral Health,

Interoperability

Why Health Information Exchange is Important for EHR Use

READ MORE >

Interoperability

What is HL7?

READ MORE >

Behavioral Health

Inside Behavioral Health: What is a CCBHC?

READ MORE >

Behavioral Health,

Public Health

How Interoperability Strengthens Whole-Person Care

READ MORE >

Industry News

North Carolina Requires Opioid E-Prescribe

READ MORE >

Medical Billing,

Financial Wellness

Connecting to NC HealthConnex

READ MORE >

Financial Wellness,

Healthcare Technology

Ten Indicators That You Should Replace and Modernize Your EHR System

READ MORE >

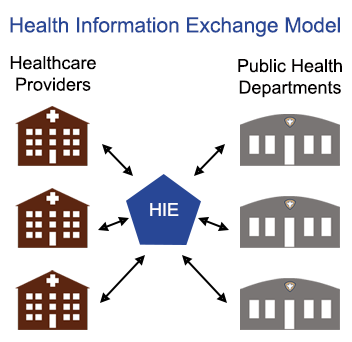

Interoperability

What is the NC HIE?

READ MORE >

Financial Wellness

Will Your Staff Adopt Your New EHR Software?

READ MORE >

Patagonia Health News

Patagonia Health Welcomes Harbi Dhanjal as VP of Engineering

READ MORE >

Patagonia Health News,

Customer Story

Mental Health Association in Passaic County Partners with Patagonia Health

READ MORE >

Patagonia Health News

Patagonia Health Wins 2019 Customer Service Award

READ MORE >

Financial Wellness

6 Ways to Optimize Your EHR

READ MORE >

Behavioral Health,

Interoperability

CMS and ONC Propose New Rules for Interoperability

READ MORE >

Patagonia Health News

Site Code Filter Added to Billing System

READ MORE >

Digital Voice Assistants in Healthcare

READ MORE >

Financial Wellness,

Healthcare Technology

How to Choose the Right EHR for Your Organization

READ MORE >

Financial Wellness

3 Critical Questions for Choosing Your EHR

READ MORE >

Patagonia Health News

Patagonia Health Expands EHR for Home Visit Intervention Tracking

READ MORE >

Patagonia Health News

Vaccine Inventory App is Enhanced

READ MORE >

Patagonia Health News

Custom Reports Added to EHR

READ MORE >

Patagonia Health News

Patient Consent Forms Are Now Editable

READ MORE >

Patagonia Health News

Patagonia Health Hires Amos Slaymaker as VP of Sales

READ MORE >

Patagonia Health News

Bi-directional Lab Orders Interface

READ MORE >

Patagonia Health News

Behavioral Health Agencies Successfully Connected to NCHIE via Patagonia Health EHR

READ MORE >

Patagonia Health News

Patagonia Health's EHR Software Earns ONC Health IT Certification

READ MORE >

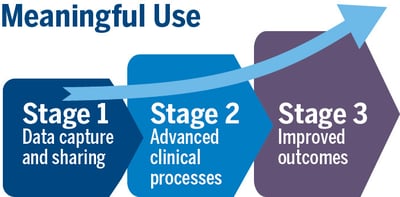

Patagonia Health News

Meaningful Use Stage 3 Certification is Complete!

READ MORE >

Behavioral Health

Having the Right Tool at the Right Time

READ MORE >

Financial Wellness

Not all EHR Vendors are Created Equal

READ MORE >

Behavioral Health,

Public Health

Setting the Stage: Patient Satisfaction Begins at Check-In

READ MORE >

Financial Wellness

EHR Support and Training: What Sets the Best Apart

READ MORE >

Patagonia Health News

Patagonia Health to Roll out New Patient ID Scanner

READ MORE >

Public Health

E-cigarette Effects and Hazards

READ MORE >

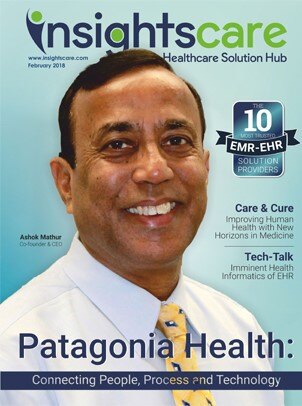

Patagonia Health News

Patagonia Health Makes Top 10 Most Trusted EHR Vendors List

READ MORE >

Behavioral Health

EHR Use Case for Smoking Behavior Cessation

READ MORE >

Patagonia Health News

Patagonia Health Wins GOLD!

READ MORE >

Public Health

When battling the Flu season, EHR technology can help

READ MORE >

Financial Wellness

Switching from Legacy to Cloud Based EHR

READ MORE >

Patagonia Health News

Patagonia Health EHR Wins 2018 GOLD Stevie® for Customer Service

READ MORE >

Patagonia Health News

Patagonia Health adds New eCQMs to EHR

READ MORE >

Financial Wellness

Will Mental Health Providers get EHR incentives

READ MORE >

Healthcare Technology

3 Ways (+1 bonus) EHR Data Helps Calm the Opioid Crisis

READ MORE >

Financial Wellness

In the Aftermath of Hurricanes, Your Choice of EHR Matters

READ MORE >

Patagonia Health News

Patagonia Health Named Top 10 EHR Solution by Healthcare Tech Magazine

READ MORE >

Financial Wellness

Is Your EHR Vendor Legit? The Top 4 things to Find Out

READ MORE >

Public Health,

Interoperability

Immunization Registries: Benefits for Healthcare Organizations

READ MORE >

Data Security

2-Factor Authentication: A shield for PHI against hackers

READ MORE >

Patagonia Health News

Save Paper and Time with built-in Electronic Patient Consent Forms

READ MORE >

Behavioral Health

Pushing Mental Healthcare Quality to the Forefront

READ MORE >

Patagonia Health News

Patagonia Health Supports 2-Factor Authentication

READ MORE >

Public Health

User-Centered Design Process

READ MORE >

Public Health,

Healthcare Technology

Vaccine-Preventable Diseases: Public Health vs Personal Choice

READ MORE >

Public Health,

Patient Experience

Keeping Patient Safety a Priority in your Health Center

READ MORE >

Behavioral Health,

Public Health

Health in All Policies – What it means for Mental Health

READ MORE >

Financial Wellness

The 6 Steps EHR Selection & Implementation: Plan for Planning

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Julia Caplan, MPP, MPH

READ MORE >

Patagonia Health News

Patagonia Health Wins Bronze Stevie Award for Customer Service Excellence

READ MORE >

Data Security

4 Reasons Not Conducting a Security Risk Assessment Can Cost You Money

READ MORE >

Patagonia Health News

Patagonia Health Partners Offers Security Risk Assessment

READ MORE >

Public Health

A Balancing Act for Public Health Departments. 3 things to focus on

READ MORE >

Public Health,

Interoperability

Is the value of participating in Health Information Exchange (HIE) worth it for public health departments?

READ MORE >

Industry News

Dealing with Change: Managing the Uncertainty in Healthcare

READ MORE >

Data Security

8 Common HIPAA Breaches to Avoid and What to Look for in Your EHR

READ MORE >

Practice Management

Check your Tables: Common UDS Reporting Mistakes

READ MORE >

Financial Wellness

Three Steps to Make the Most of EHR Vendor Demos

READ MORE >

Patient Experience,

Expert Interviews

Expert Interview: Marni Mason, BSN, MBA

READ MORE >

Behavioral Health,

Industry News

Addiction in America: A $420 Billion-dollar fight in Behavioral Health

READ MORE >

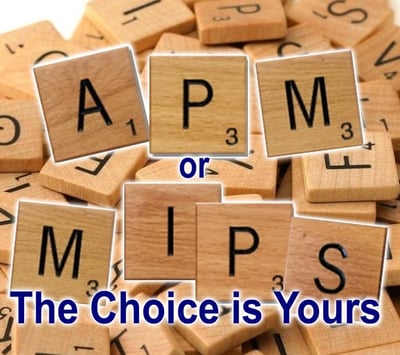

Medical Billing,

Financial Wellness

Quality patient care with new Medicare Payment System (MACRA)

READ MORE >

Industry News

Affordable Care Act Open Enrollment and Community Health (FQHC)

READ MORE >

Patagonia Health News

Patagonia Health Ranks 865 on Inc. 5000 Fastest-Growing Companies List

READ MORE >

Patagonia Health News

Boost Productivity and Cut Costs with Electronic Fax

READ MORE >

Behavioral Health,

Public Health

Without a certified EHR, clinics are missing out on benefits of eRX

READ MORE >

Medical Billing,

Financial Wellness

How Accountable Care Organizations Improve Community Health

READ MORE >

Financial Wellness

Five Steps to a Successful EHR Data Migration

READ MORE >

Patagonia Health News

Streamline your community health center with improved UDS Reporting options

READ MORE >

Financial Wellness

7 Levels of Service & Support You Should Demand from Your EHR Vendor

READ MORE >

Patagonia Health News

Quick Photo Capture Currently Now in Pilot Mode

READ MORE >

Patagonia Health News

New Bar Code Scanner Option for Immunization App

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Matthew Simon, MA, GISP

READ MORE >

Patagonia Health News

Patagonia Health Expands; Relocates Headquarters

READ MORE >

Behavioral Health,

Public Health

EHR Incentive Program Unites Behavioral and Public Health Agencies

READ MORE >

Industry News,

Financial Wellness

FQHC Guide to the 340B Drug Program

READ MORE >

Medical Billing,

Financial Wellness

Are You Down with PPS?

READ MORE >

Financial Wellness

21 Steps to a Successful EHR Implementation

READ MORE >

Practice Management,

Data Security

Understand HIPAA violations to prevent them from happening to you

READ MORE >

Public Health

What's in your Family Planning Annual Report? (FPAR)

READ MORE >

Financial Wellness,

Healthcare Technology

Time is Money: FQHC Requirements from their EHR

READ MORE >

Patagonia Health News

Workflow Analysis & Optimization Services

READ MORE >

Patagonia Health News

Patagonia Health Wins 2016 Bronze Stevie® Award

READ MORE >

Interoperability,

Expert Interviews

Expert Interview: Ross D. Martin, MD, MHA

READ MORE >

Patagonia Health News

Patagonia Health makes the list of most promising RTP tech companies

READ MORE >

Medical Billing,

Expert Interviews

Expert Interview: Laurie A. Poulin, CPC

READ MORE >

Financial Wellness

Will Your EHR Vendor Conduct Workflow Analysis for Public Health?

READ MORE >

Patagonia Health News

Patagonia Health Carries Customers Safely Across the ICD-10 Threshold

READ MORE >

Public Health

Public Health Departments: Improve Workflow AND EHR Implementation

READ MORE >

Public Health

Credentialing Made Easier for Local Health Departments

READ MORE >

Financial Wellness

EHR User Groups: The Benefits of Group Learning

READ MORE >

Patient Experience,

Patient Portal

The benefits of an EHR from the patient’s perspective

READ MORE >

Industry News,

Practice Management

Implementing EHRs at Title X Agencies

READ MORE >

Patagonia Health News,

Customer Story

Cleveland County Health Dept: Public Health EHR Implementation

READ MORE >

Patagonia Health News

Patagonia Health Ranks Top 5% on Inc. 5000 List

READ MORE >

Public Health,

Industry News

Patagonia Health EHR; Making things easier for healthcare professionals

READ MORE >

Interoperability

What is Health Information Exchange and Why is it Important for EHR use?

READ MORE >

Practice Management

What is your Strategy for Medical Record Scanning

READ MORE >

Patagonia Health News,

Customer Story

Rowan County Replaces Legacy EHR Software with Patagonia Health

READ MORE >

Public Health

Working Together: Top 10 Public Health Achievements in 10 year span

READ MORE >

Patagonia Health News,

Customer Story

Patagonia Health Aids County Health Departments to Successful Attestations

READ MORE >

Patagonia Health News

Meaningful Use EHR Incentive Assistance Service

READ MORE >

Data Security

6 Things Your EHR Must Do to Secure Patient Information

READ MORE >

Medical Billing,

Financial Wellness

3 steps to increase reimbursements for public health departments

READ MORE >

Patagonia Health News,

Customer Story

Nash County Health Department Adopts Patagonia Health EHR

READ MORE >

Interoperability,

Practice Management

EHR-HIE Integration: Enhancing Syndromic Surveillance for Public Health

READ MORE >

Medical Billing

Understanding Medicare Incident-To Billing for Public Health

READ MORE >

Medical Billing,

Public Health

ICD-10-CM has big benefits for Public Health!

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Dr. Stephanie Bailey

READ MORE >

Public Health,

Patient Experience

EHR Photo IDs: Unique Patient Identification for Health Departments

READ MORE >

Financial Wellness

The 6 must-haves for an easy to use EHR for Local Health Departments.

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Jan O’Neill

READ MORE >

Public Health,

Interoperability

Timely data is difficult to obtain for urban public health departments

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Kevin Sherin MD, MPH, MBA

READ MORE >

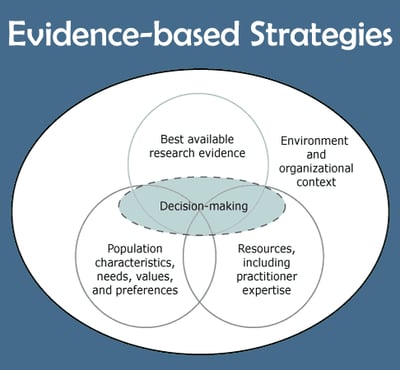

Public Health,

Patient Experience

How can EHR help with Evidence-Based Approach to improving patient health?

READ MORE >

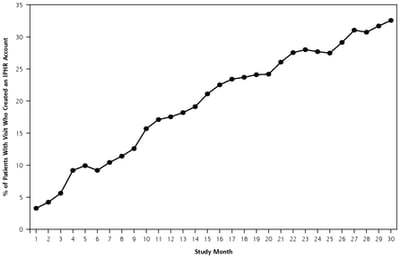

Public Health,

Patient Experience

Are Local Health Departments Ready for Patient Portals?

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Anna Schenck

READ MORE >

Patagonia Health News

EHR Dashboard App for local health departments

READ MORE >

Practice Management,

Expert Interviews

Expert Interview: John Graham, PhD

READ MORE >

Public Health

What is Public Health?

READ MORE >

Industry News,

Practice Management

What’s happening with Title X Family Planning?

READ MORE >

Sure, price is important when buying an EHR.

READ MORE >

Public Health,

Patient Experience

Medical Record Errors: They’re more likely than you think.

READ MORE >

Financial Wellness

7+1 bonus steps for EHR selection for local health departments

READ MORE >

Public Health,

Healthcare Technology

The power of data in a blackout: LHD preparedness & emergency response

READ MORE >

Healthcare Technology

When it comes to EHR adoption, where does public health rank?

READ MORE >

Patient Experience,

Industry News

Why Doctors Resist Mobile Health Despite Patient Demand

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Dr. Susan Zepeda

READ MORE >

Public Health,

Industry News

Are fist-bumps the new handshake for public health?

READ MORE >

Industry News

The Center for Healthy North Carolina releases its latest “Snapshot of Success”

READ MORE >

Public Health,

Patient Experience

How texting is benefiting public health

READ MORE >

Public Health

Pestronk encourages local health department leaders

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Robert Pestronk

READ MORE >

Public Health

Public health and prevention: From behind the scenes to center stage

READ MORE >

Public Health,

Patient Experience

Mobile Apps: Transforming Public Health

READ MORE >

Public Health,

Expert Interviews

Expert Interview: Laura Edwards

READ MORE >

Patagonia Health News

NC HIE Partners with Patagonia Health and NC Office of Rural Health

READ MORE >

Public Health,

Expert Interviews

Expert Interview – Rebecca Williams, MHS, PhD

READ MORE >

Patagonia Health News

Patagonia Health Receives ONC-ACB Certification by Drummond Group

READ MORE >

Patagonia Health News

Public Health Selects Patagonia Health for EHR Billing Solutions

READ MORE >

Patagonia Health News

Patagonia Health Launches Behavioral Health EMR with Built-in Forms

READ MORE >

Patagonia Health News

Patagonia Health EHR is federally certified for Meaningful Use 2011

READ MORE >

Patagonia Health News

Patagonia Health Named Top NC Startup

READ MORE >

Load More

Subscribe for More Helpful Content From the Patagonia Health Team!

Need guidance?

Schedule a free 20-minute consultation.

Have questions about how Patagonia Health can meet your needs? Our team of experts is ready to help.